Contents

- Financials - Journal Upload

- Field Descriptions

- Batch Header Fields

- Accrual Reversal Period

- Accrual Reversal Year Indicator

- Balance Class

- Base Currency Credits

- Base Currency Debits

- Batch Date

- Batch Reference

- Batch Type

- BTZ Element

- Company

- Currency

- Description

- Effective Date

- Foreign Currency Credits

- Foreign Currency Debits

- Number of Periods

- Number of Transactions

- Period

- Rate Type

- Value Date

- Year Indicator

- Quantity Value

- Transaction Detail Fields

Journal Upload

Updated

by Caroline Buckland

Updated

by Caroline Buckland

- Financials - Journal Upload

- Field Descriptions

- Batch Header Fields

- Accrual Reversal Period

- Accrual Reversal Year Indicator

- Balance Class

- Base Currency Credits

- Base Currency Debits

- Batch Date

- Batch Reference

- Batch Type

- BTZ Element

- Company

- Currency

- Description

- Effective Date

- Foreign Currency Credits

- Foreign Currency Debits

- Number of Periods

- Number of Transactions

- Period

- Rate Type

- Value Date

- Year Indicator

- Quantity Value

- Transaction Detail Fields

Financials - Journal Upload

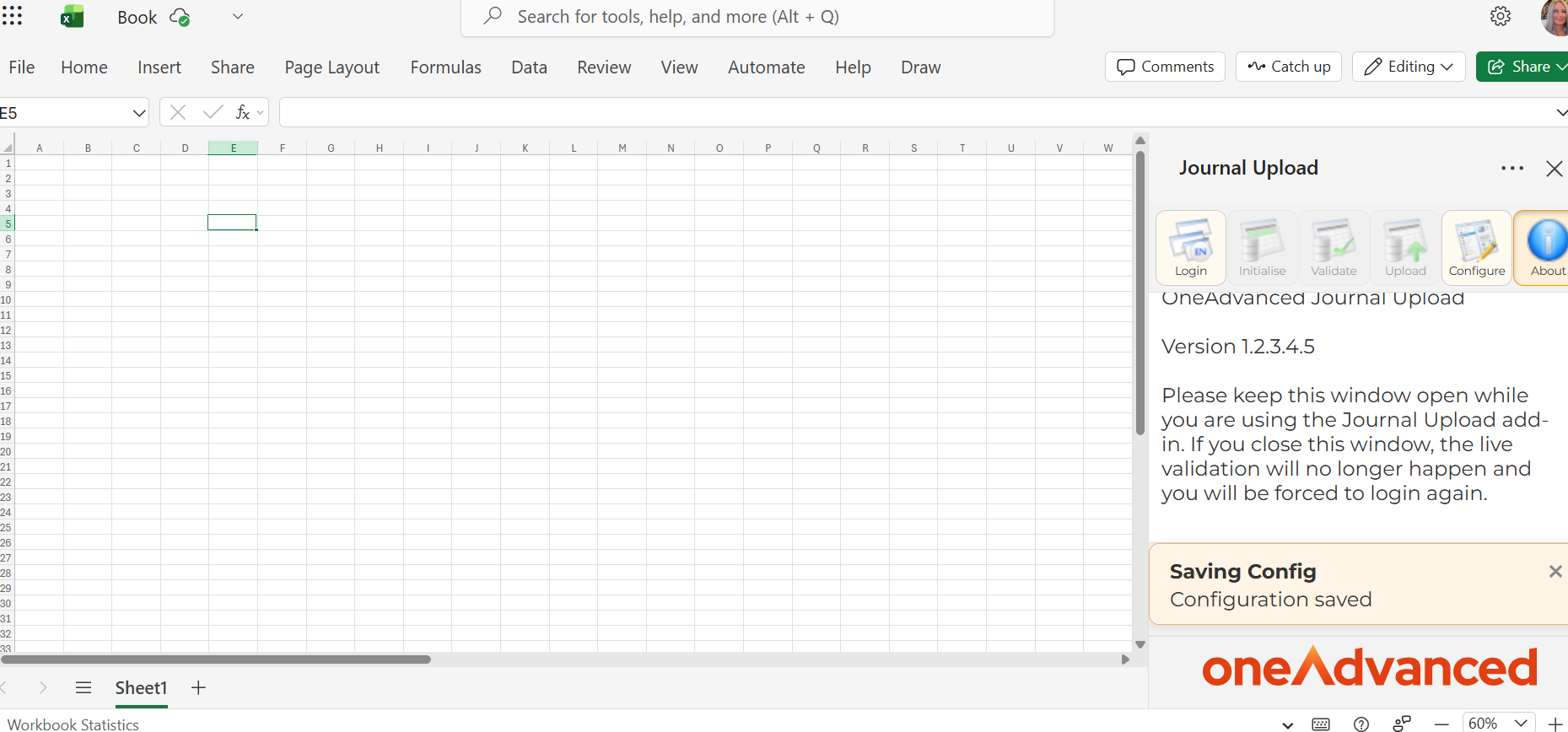

The Journal Upload process lets users enter standard, recurring and accrual journals into Microsoft Excel before validating and uploading them into Financials.

Installation

- Excel - Online Versions

- Setup Add-in for Excel - Online

To install the Journal Upload Add-in for either Excel for the Web or Excel Desktop:-

For Excel for the web

- Open Excel for the web.

- Select New- Blank workbook

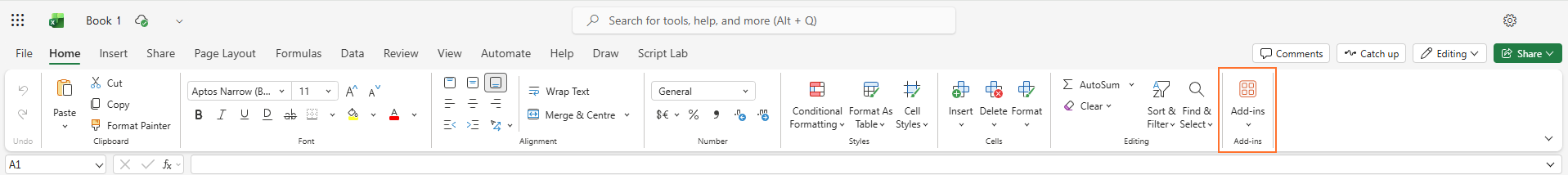

- From Excel, click on the 'Home' tab and select 'Add-ins' then ‘ + More Add-ins’:

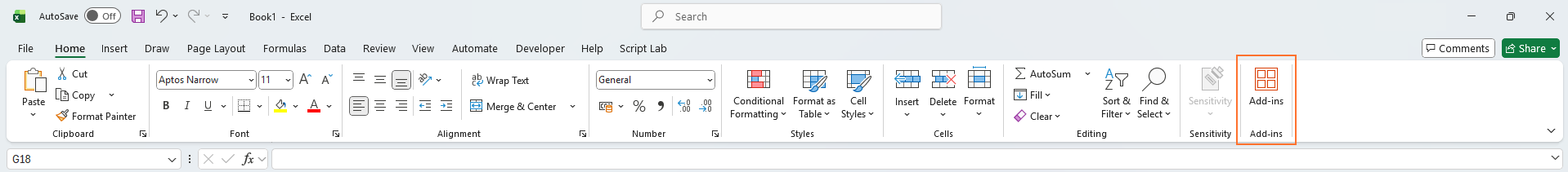

For Desktop Excel

- Open Excel Desktop

- Select New – Blank workbook

- From Excel, click on the 'Home' tab and select 'Add-ins' then ‘ + More Add-ins’:

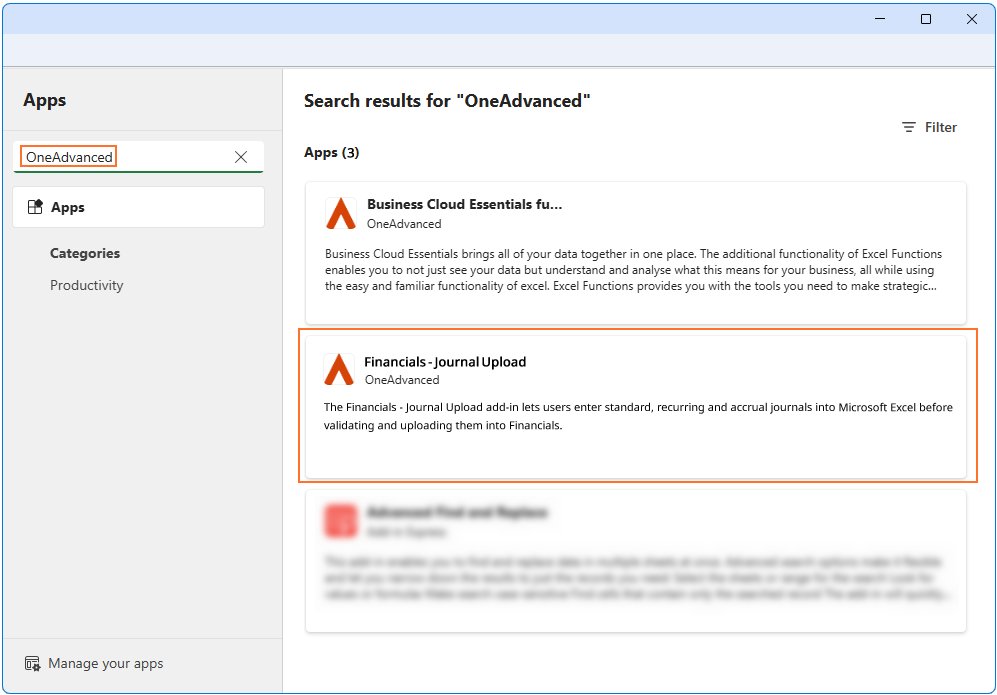

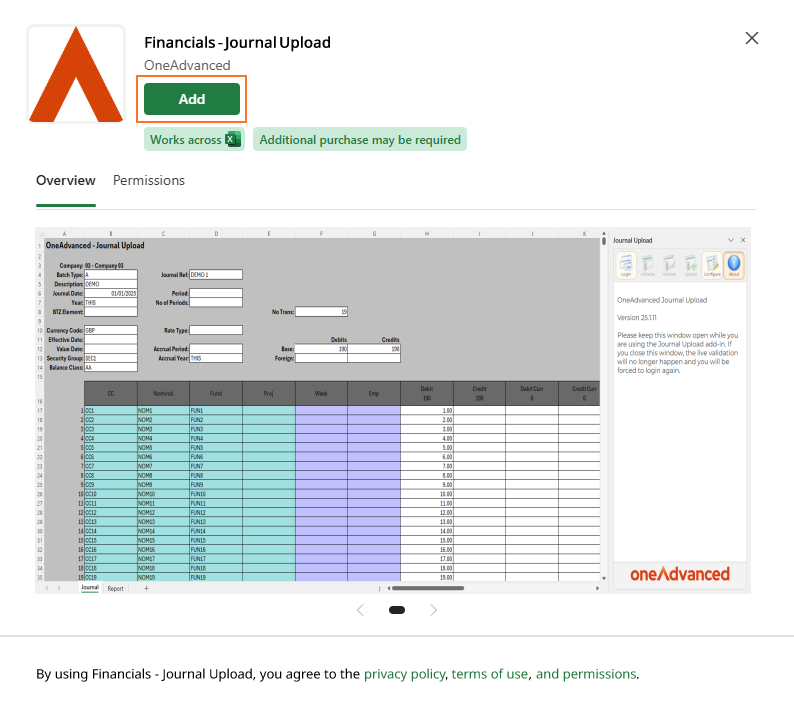

For both Web and Desktop, from the Office store, search for 'OneAdvanced' and the 'Financials – Journal Upload' will show in the available list:

Click on the Add button and accept the licence terms by clicking on the 'Continue' button:

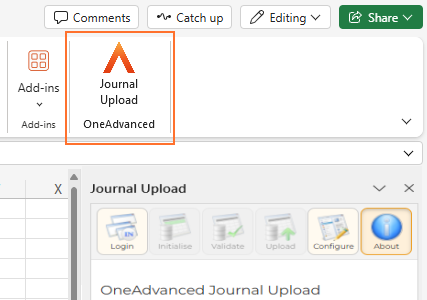

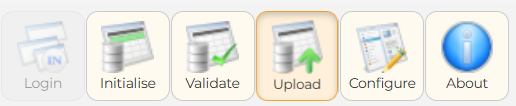

The Journal Upload button will be displayed on the menu ribbon, indicating the 'Add-in' has been successfully installed:

Configuration

Before using the Journal Upload add-in you must configure the connection to the Financials system.

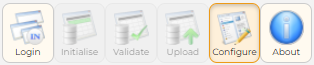

Click on the Configure button and the settings will appear in the task pane to the right of the spreadsheet.

Enter the following details.

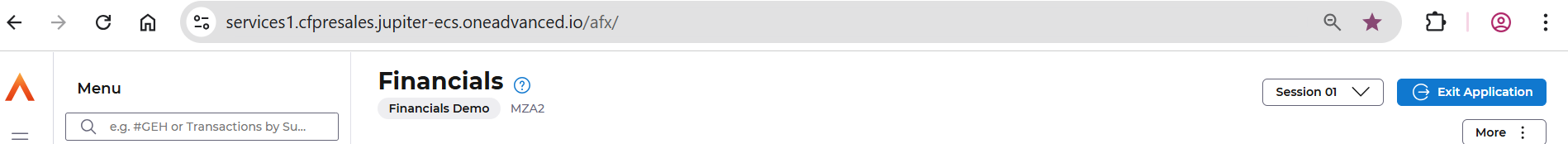

URL: The URL of the Financials system you wish to connect to, this can be found once you login to Financials.

i.e. https://yourcompanynamen.cloufinancials.com

Maximum rows to initialise:

Create Debit/Credit style: will create a separate column for debits and credits, if left blank it will only display one column

The below values can be left blank, if entered the excel worksheet will produce dropdown boxes with the values displayed.

The formula is as follows:

The options should be comma separated, add [XXXX] to set the default value.

Example [GLJN], GLRV,GLRR - this will have GLJN as the default value.

- Batch Types:

- BTZ Element:

- Balance Class:

- Logging Level:

Select the Save button once complete.

You can now select the Login icon.

If you are not already logged in to MyWorkplace, the login screen will be displayed.

The following notification is displayed.

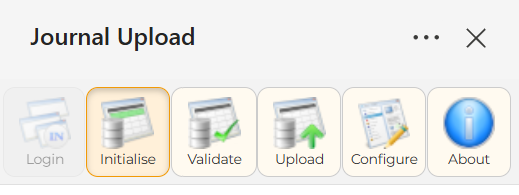

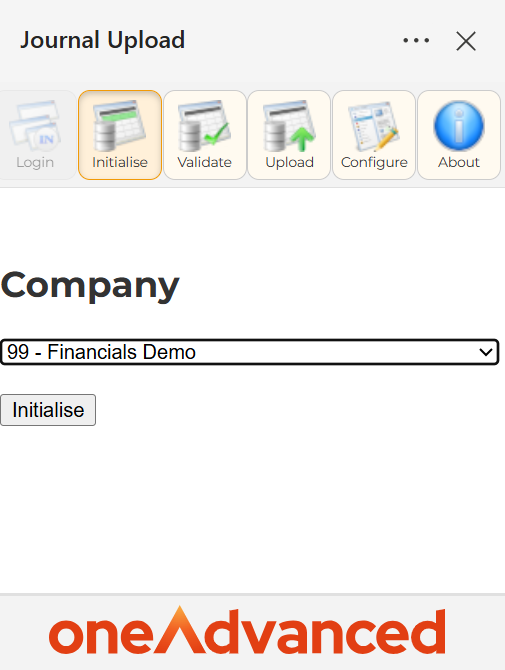

Initialisation

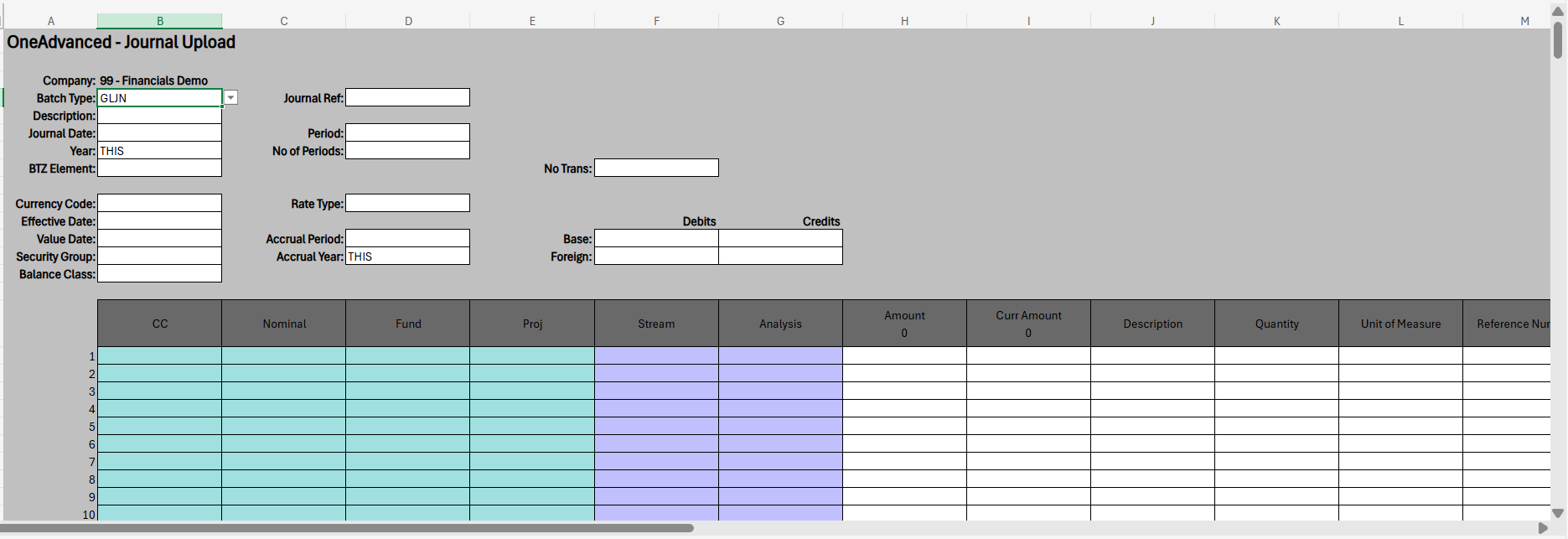

You will need to initialise the spreadsheet which will create a blank Journal Upload template sheet which you will be able to populate.

Select your company from the dropdown menu followed by the initialise button under the company dropdown.

The specific company General Ledger Account Definitions for the selected company will be displayed. If the spreadsheet already had data in it, then it would be cleared.

Field Descriptions

Batch Header Fields

Accrual Reversal Period

You may enter a reversal period for the batch if required. For a description of batches, refer to the General Ledger User Guide.

Accrual Reversal Year Indicator

You may enter a reversal year for the batch if required. For a description of batches, refer to the General Ledger User Guide.

Balance Class

You may enter a balance class. If you do not enter a balance class, a balance class of ‘AB’ will be assumed. For a description of balance classes, refer to the General Ledger User Guide. In addition, a list of available balance classes can be configured from the configuration utility.

Base Currency Credits

You may enter a base currency credit value.

Base Currency Debits

You may enter a base currency debit value.

Batch Date

You must enter a batch date. For a description of batches, refer to the General Ledger User Guide.

Batch Reference

You must enter a batch reference. For a description of batches, refer to the General Ledger User Guide.

Batch Type

You must enter a batch type. For a description of batch types, refer to the General Ledger User Guide. In addition, a list of available batch types can be configured from the configuration utility.

BTZ Element

You may enter an element. For a description of elements, refer to the General Ledger User Guide. In addition, a list of available elements can be configured from the configuration utility.

Company

This field is populated following initialisation.

Currency

You may enter a currency. If you do not enter a currency, then company base currency will be assumed. For a description of currencies, refer to the System Controls User Guide.

Description

You must enter a batch description. For a description of batches, refer to the General Ledger User Guide.

Effective Date

You may enter an effective date. This is the date the Rate Type becomes effective. For a description of effective dates, refer to the System Controls User Guide.

Foreign Currency Credits

You may enter a foreign currency credit value. Monetary value of credits entered in foreign currency.

Foreign Currency Debits

You may enter a foreign currency debit value. Monetary value of debits entered in foreign currency. This field will only appear in an advanced workbook.

Number of Periods

You may enter the number of periods for the batch. This is only required if you are using a recurrals batch type. For a description of batches, refer to the General Ledger User Guide.

Number of Transactions

You may enter the number of transactions in the batch.

Period

You may enter the period to which the batch of transactions will be posted. For a description of batches, refer to the General Ledger User Guide.

Rate Type

You may enter a rate type. For a description of rate types, refer to Business Controls Manual.

Value Date

You may enter the value date if a value dated batch type is used.

Year Indicator

Select from the dropdown list Last Year, Next Year or Current Year to specify when the batch will be posted.

Quantity Value

Optionally enter the Journal Quantity Total on the Header screen. Depending on the settings on GL Company Controls this could be mandatory. When a value is entered in the corresponding Journal Total the system will check if this agrees with the corresponding Entered Total field, after transaction quantity values have been entered through the Detail lines.

Transaction Detail Fields

Account

You must enter an account for the transaction. This field will be split depending on the company account definition.

Analysis

You may enter analysis code values for the transaction. This field will be split depending on the company account definition.

Cost Source

You may enter a cost source value for the transaction.

Cost Source Company

You may enter a cost source company for the transaction.

Cost Target Company

You may enter a cost target company value for the transaction. This field will only appear in an advanced workbook.

Cost Target

You may enter a cost target value for the transaction.

Currency Value

You may enter a foreign currency value for the transaction. This field may be split into debit and credit columns depending on the initialisation parameters. Either base or foreign currency or both values may be entered.

Destination Company

You may enter a Destination Company value for the transaction.

Detail Description

You may enter a transaction description.

Effective Date

You may enter a date relating to the exchange rate for an individual transaction.

Exchange Rate

You may enter an exchange rate.

Financial Value

You may enter a base currency value for the transaction. This field may be split into debit and credit columns depending on the initialisation parameters.

MCA

You may enter a Mini Chart of Accounts code for the transaction.

Project

If Project Tracking is in use, you may enter project code values for the transaction. This field will be split depending on the company project definition. If Project Tracking is not active, then this can be used as a memo field.

Quantity

You may enter statistical information related to a particular transaction.

Rate Type

You may enter a rate type that applies to this transaction.

Reconciliation Code

You may enter a transaction reconciliation code.

Reference Number

You may enter a reference number of up to six characters to mark an individual transaction (as opposed to the general Reference number entered on the Batch Header). This can be used within the General Ledger inquiries to search for individual transactions.

Tax Code

You may enter a tax code that applies to this transaction. This is an optional field but if the tax code is entered then it must have been previously defined within Financials.

Tax Location

You may enter a tax location that applies to this transaction. This is an optional field but if the tax location is entered then it must have been previously defined within Financials.

Tax Type

You may enter a tax type that applies to this transaction. This is an optional field but if the tax type is entered then it must have been previously defined within Financials.

Transaction Date

You may enter a transaction date.

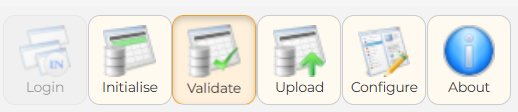

Validation

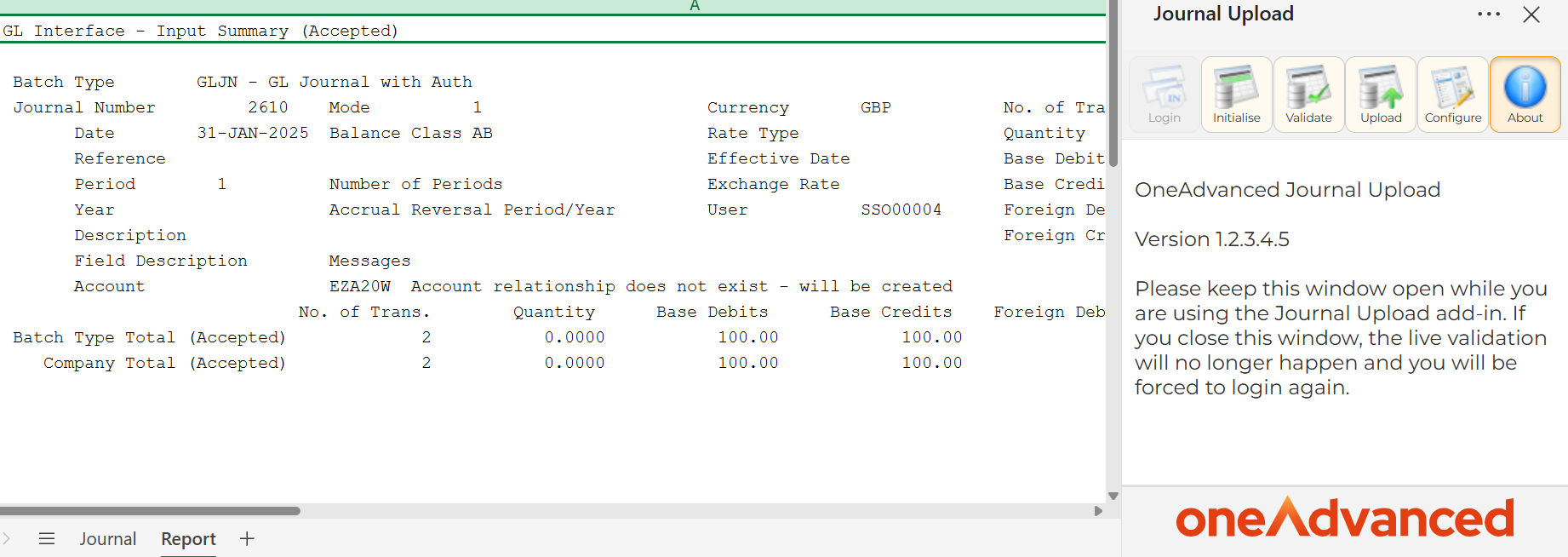

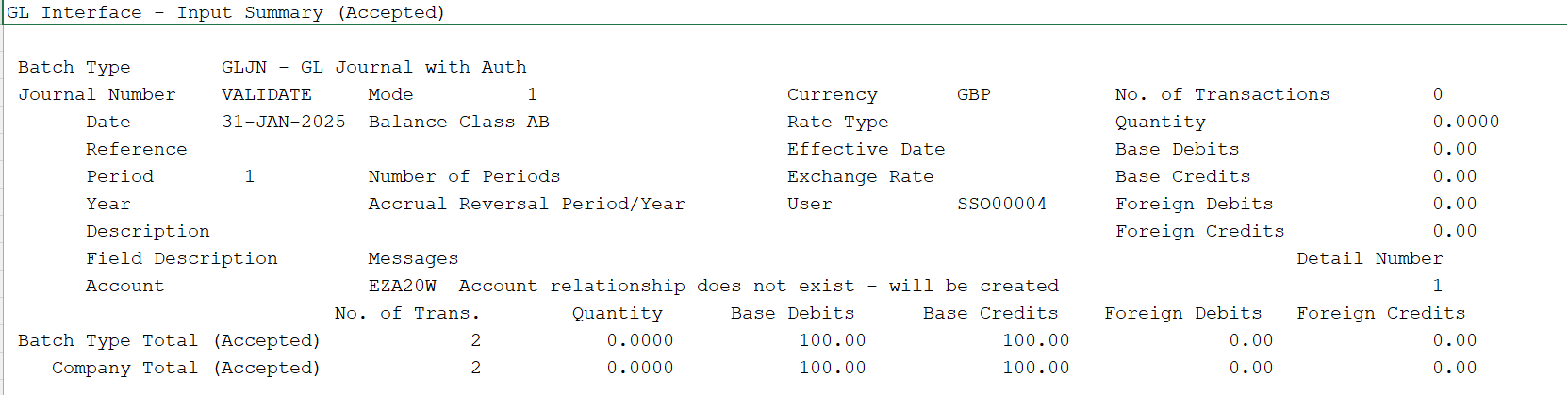

Once complete, select the Validate icon.

A report is returned from Financials and displayed on the ‘Report’ tab of the spreadsheet.

Any errors will be reported, amendments can be made and then validated again.

Upload

The Upload action can then be used.

A report is returned from Financials and displayed on the ‘Report’ tab of the spreadsheet.