Contents

Bank Reconciliation Enquiries

Updated

by Caroline Buckland

Updated

by Caroline Buckland

Bank Reconciliation Enquiries

Enquiries

Overview

All bank reconciliation enquiries are to be accessed from the ‘Bank Reconciliation Enquiry’ menu.

The Bank Reconciliation System provides the user with two different summary Bank Reconciliation enquiries – the Reconciliation Summary and the Reconciliation Enquiry Summary. Both enquiries will provide the user with a summarised on-line reconciliation between the Bank Statement balance and the cashbook. Reconciling items will be summarised and differences highlighted.

The Reconciliation Summary identifies the current Bank and Cashbook balances and summarises the differences in terms of Bank and GL adjustments. The Reconciliation Enquiry Summary also looks at the current bank and cashbook balances but categorizes differences according to their source system. This enquiry will be particularly useful for those organisations that are using the E5 Accounts Payable and Accounts Receivable Modules, as unpresented cheques and deposits not banked are highlighted as separate figures.

Both these enquiries contain a field “Difference”. If the reconciliation is correct, this field will always have a value of zero. If it contains a figure other than zero, then an investigation is required. The summary enquiries will only be correct if all GL postings affecting the General ledger Bank Account have processed successfully. If a balance exists in the “Difference” field, it is suggested the user check the Review in Error Batches Listing (MEDA) and identify and correct any batches that contain postings for the selected bank account. Once the batches have been processed, the summary enquiry should be in balance.

- Unpresented Payments List

- Deposits Not Banked List

- Miscellaneous Items Not Reconciled

- Bank Items Not Reconciled.

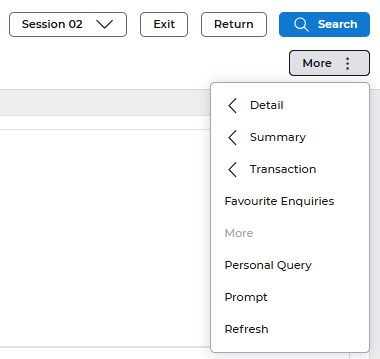

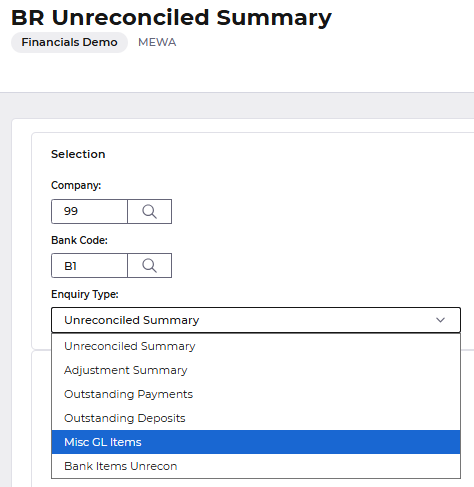

Navigate to: Main Menu > Bank Reconciliation > Bank Reconciliation Enquiries and select each option in turn, or use the drop down from the current enquiry screen.

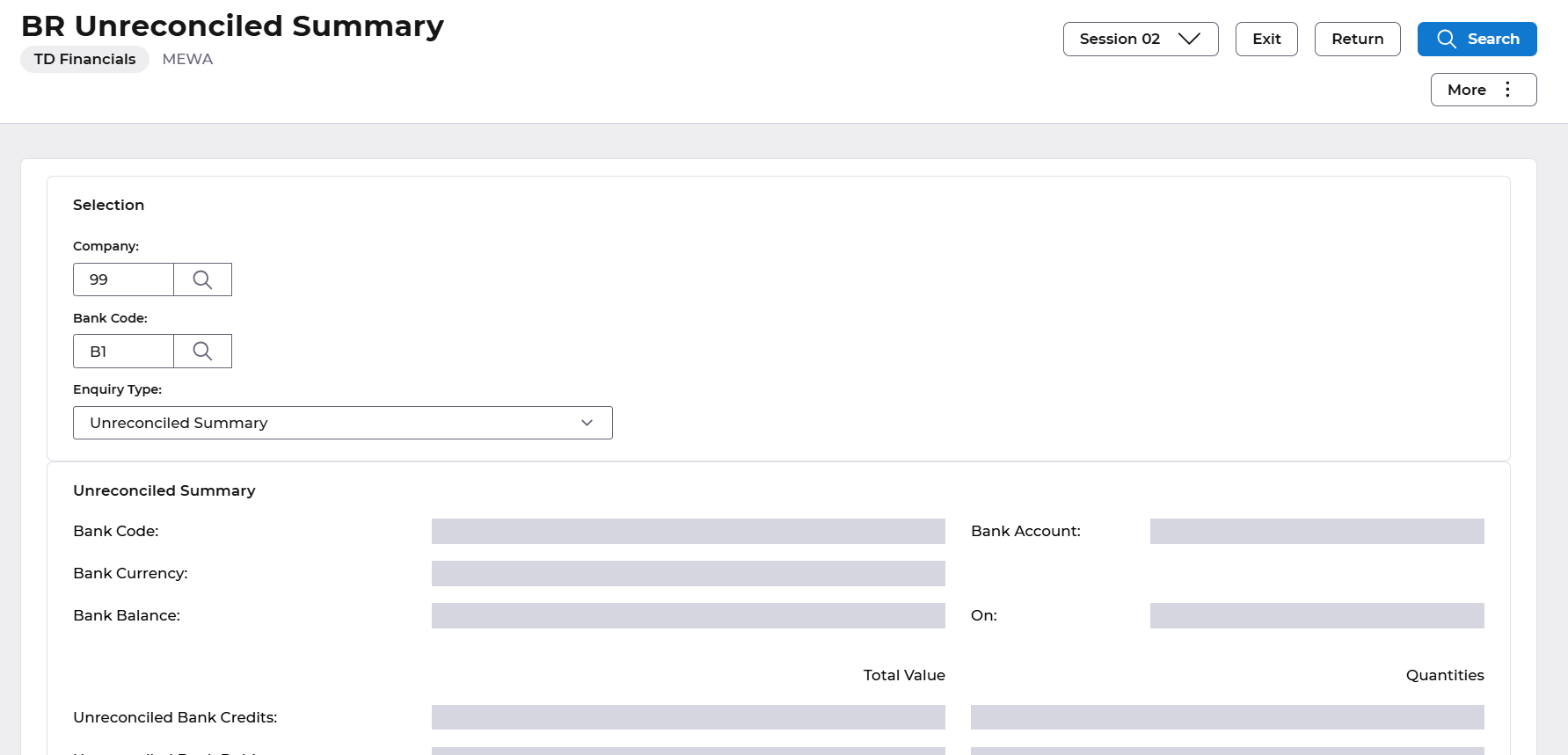

Reconciliation Summary

The following fields are mandatory:-

Company Enter a two character company code for which Bank Reconciliation Company Controls have been created. Current user company will default into this field.

Bank Code Enter the two character bank code corresponding to the required bank account.

Enquiry Leave as default or select different enquiry from pull down menu.

Select the 'Search’ button, the user will be presented with the Reconciliation Summary.

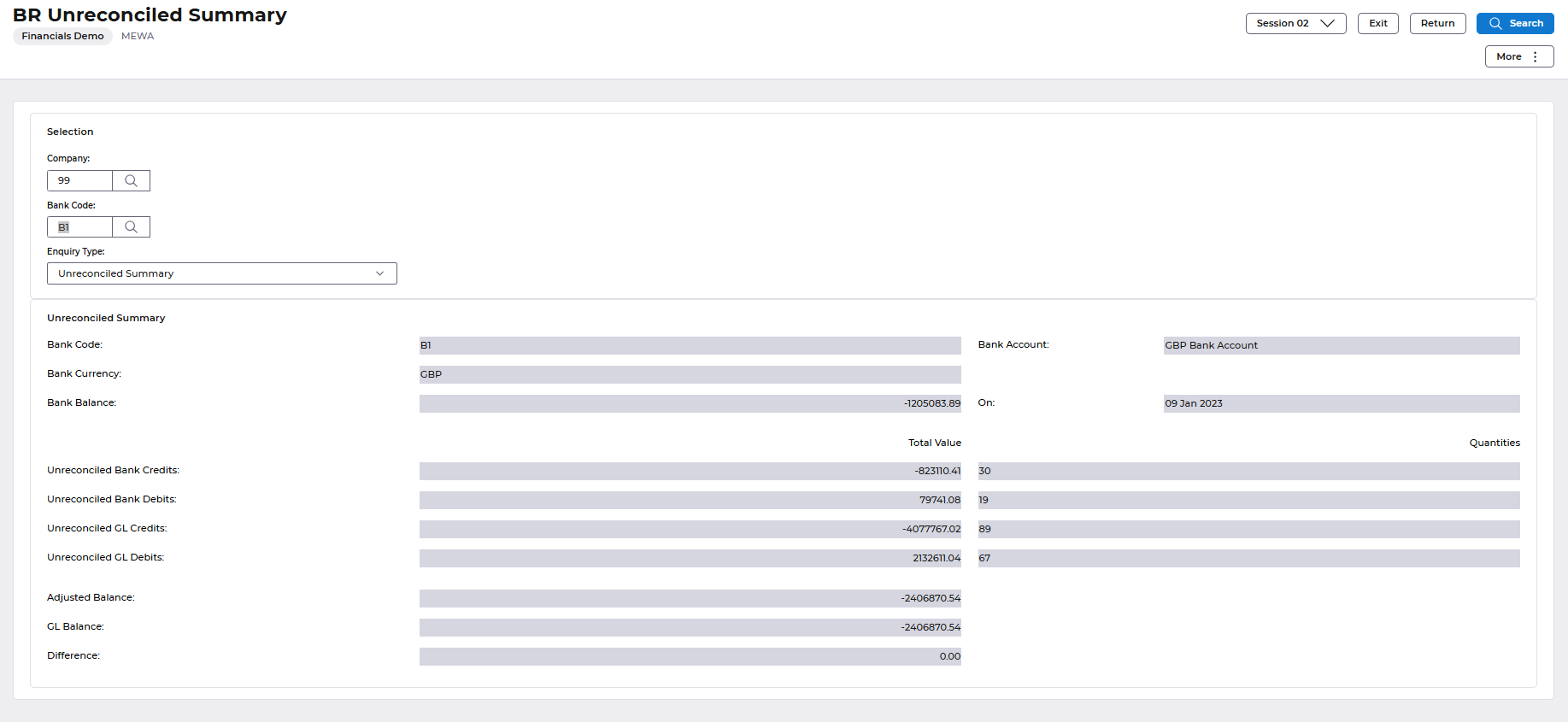

The balances shown are as follows:-

Bank Balance - This figure is the closing balance on the last Bank Statement to be imported into the system. It is taken from the “closing balance” on the Bank Code screen (ME03).

Unreconciled Bank Credits - Total of all unreconciled credits held in the Bank Statement Balance Class of the GL account code representing the bank account.

Unreconciled Bank Debits - Total of all unreconciled debits held in the Bank Statement Balance Class of the GL account code representing the bank account.

Unreconciled GL Credits - Total of all unreconciled credits held in the 'AB' and Adjustment Balance Classes of the GL account code representing the bank account.

Unreconciled GL Debits - Total of all unreconciled debits held in the 'AB' and Adjustment Balance Classes of the GL account code representing the bank account.

Adjusted Balance - This is a calculated field based on the information above. The formula is Bank Balance – (Unreconciled Bank Debits & Credits) + (Unreconciled GL Debits & Credits).

GL Balance - This figure is the Current Balance for the GL account code representing the bank account.

Difference - This is a calculated field based on the Adjusted Balance - the GL Balance. This figure should always be zero. If a balance exists in this field, refer back to the Overview for this section.

Use the More button to view more actions available from this screen.

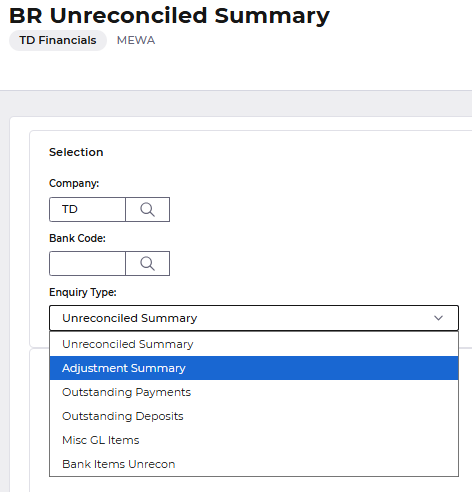

Reconciliation Adjustment Summary

This enquiry allows the user to view on a single screen the current balance of both the GL Account and the Bank Statement, and the summary values of unreconciled items identified by source system:

The following fields are mandatory:-

Company Enter a two character company code for which Bank Reconciliation Company Controls have been created. Current user company will default into this field.

Bank Code Enter the two character bank code corresponding to the required bank account.

Enquiry Leave as default or select different enquiry from pull down menu. Select the 'Search' button, the user will be presented with the Reconciliation Enquiry Summary.

The balances shown are as follows:-

Bank Balance - This figure is the closing balance on the last Bank Statement to be imported into the system. It is taken from the “closing balance” on the Bank Code screen (ME03).

Outstanding Payments - Total of all unreconciled payment transactions sourced from the Accounts Payable System, held against the GL account code representing the bank account.

Outstanding Deposits Not Banked - Total of all unreconciled deposits sourced from the Accounts Receivable System held against the GL account code representing the bank account.

Miscellaneous GL Items - Total of all other unreconciled transactions held in the 'AB' Balance Class of the GL account code representing the bank account.

Bank Items Unreconciled - Total of all unreconciled transactions held in the Bank Statement and Bank Adjustment Balance Classes of the GL account code representing the bank account.

Adjusted Balance - This is a calculated field based on the information above. The formula is Bank Balance + Unpresented Payments + Deposits Not Banked + Miscellaneous GL Items – Bank Items Unreconciled.

GL Balance - The Current Balance for the GL account code representing the bank account.

Difference - This is a calculated field based on the Adjusted Balance - the GL Balance. This figure should always be zero. If a balance exists in this field, refer back to the Overview for this section.

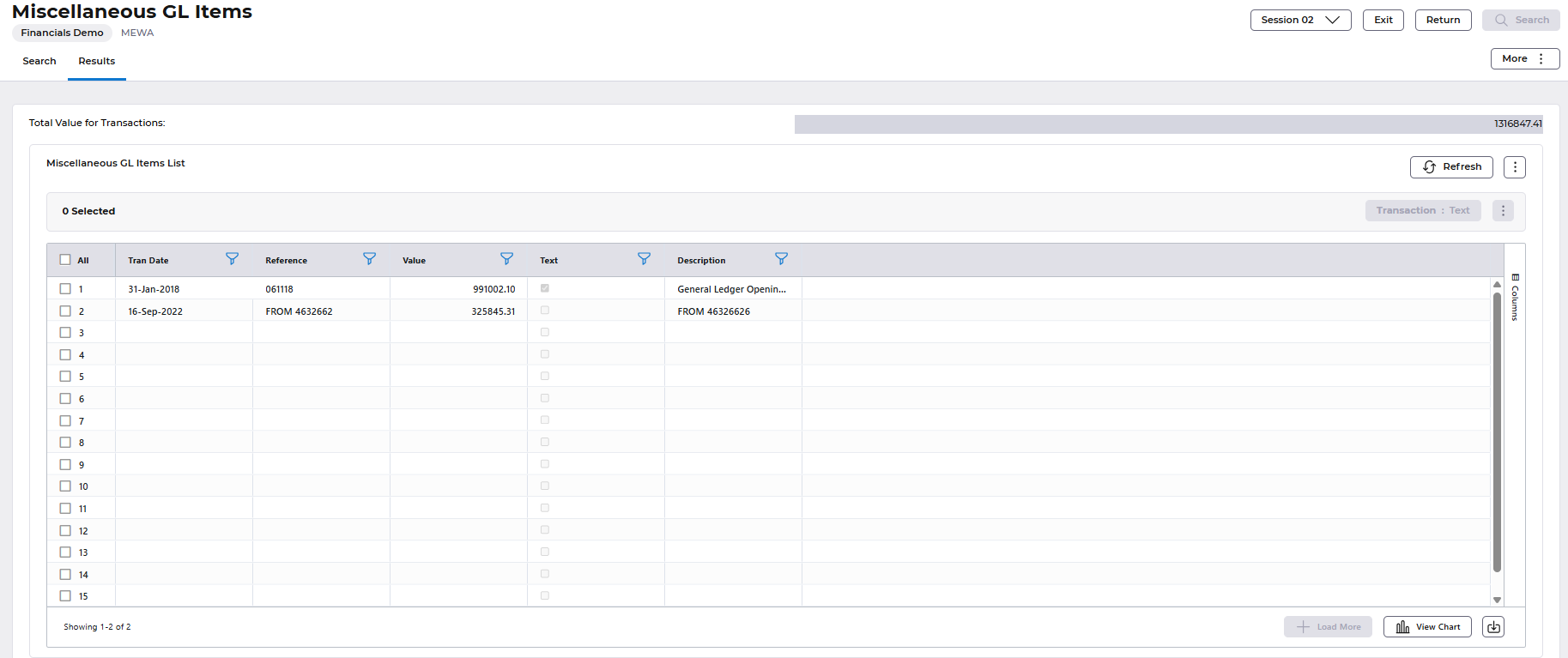

Cashbook Items Unreconciled (Miscellaneous GL items unreconciled)

This screen will display a list of miscellaneous General Ledger transactions not yet reconciled. This listing excludes those items which have already been included in the Unpresented Payments Listing and the Deposits Not Banked Listing.

The following fields are mandatory:-

Company Enter a two character company code for which Bank Reconciliation Company Controls have been created. Current user company will default into this field.

Bank Code Enter the two character bank code corresponding to the required bank account.

Enquiry Leave as default or select different enquiry from pull down menu.

Select the 'Search' button, the user will be presented with the Unreconciled GL Items List.

The following information is displayed: -

Transaction Date: The general ledger transaction date

Reference: Reconciliation Number

Description: Transaction Detail

Value: Transaction Value

The Excel download button is available from this screen.

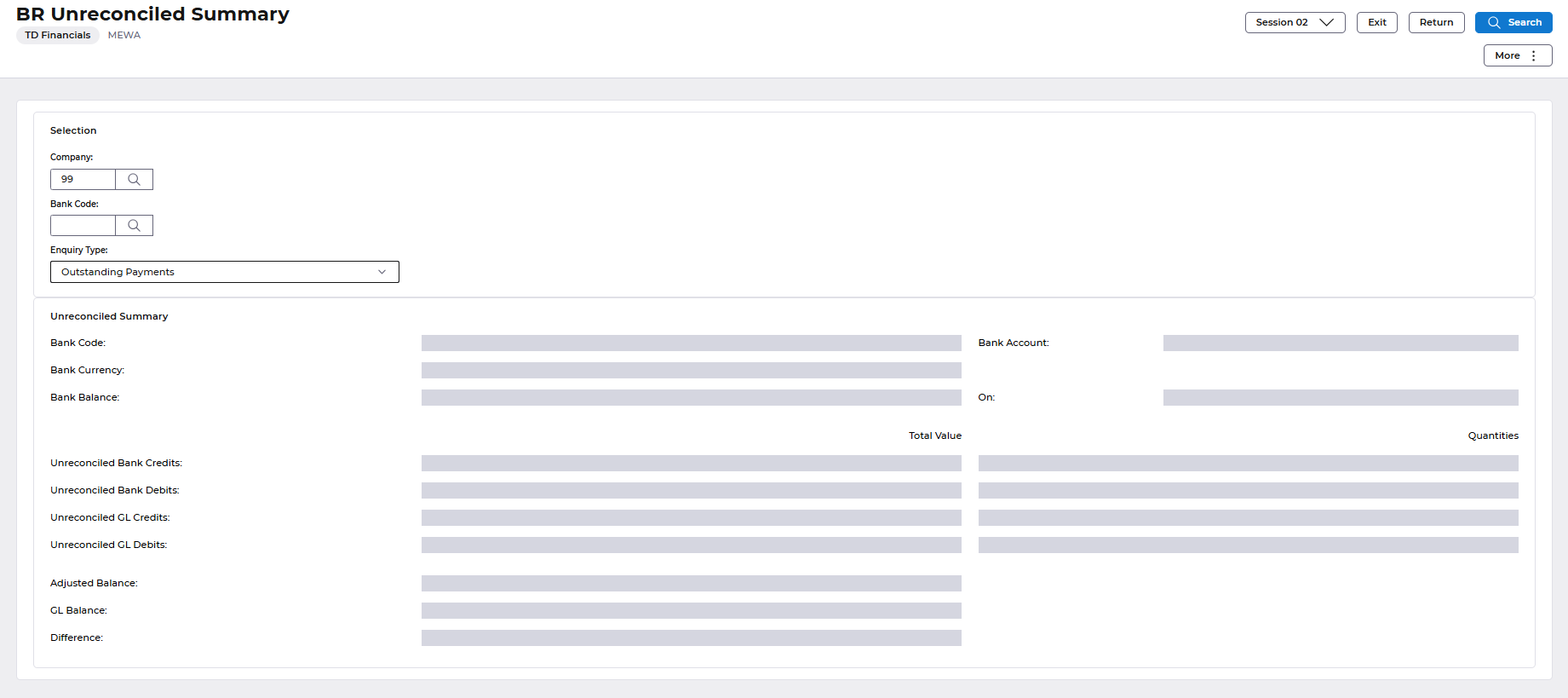

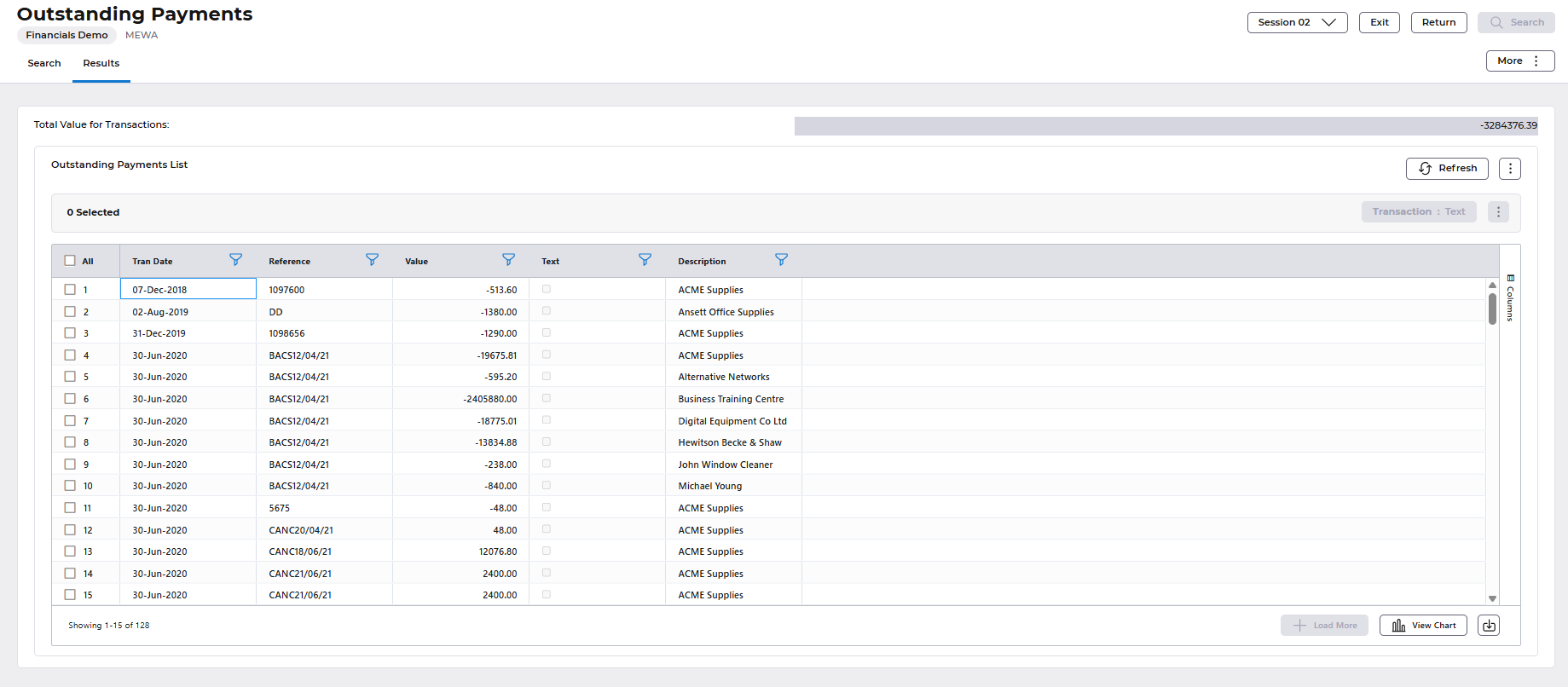

Outstanding Payments List

Using this screen, the user will be able to view a list of all payments produced in Accounts Payable that are yet to be presented. It provides a detailed listing to support the “Unpresented Payments” figure on the Summary Enquiry Reconciliation.

The following fields are mandatory:-

Company Enter a two character company code for which Bank Reconciliation Company Controls have been created. Current User Company will default into this field.

Bank Code Enter the two character bank code corresponding to the required bank account.

Enquiry Leave as default or select different enquiry from pull down menu.

Select the 'Search' button, the user will be presented with the Outstanding Payments List

The screen is very similar to the Miscellaneous GL Items screen and the following information is displayed:

Transaction Date: The General Ledger transaction date

Reference: Cheque Number or EFT reference

Description: Supplier Name

Value: Payment Value

The Excel download button is available from this screen.

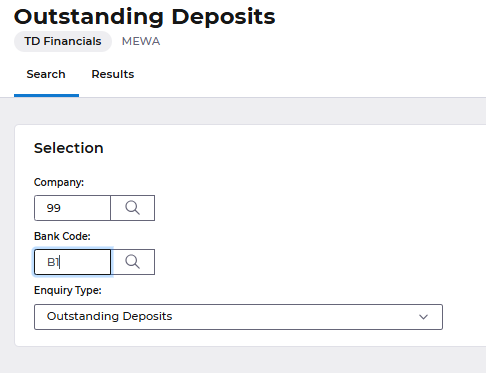

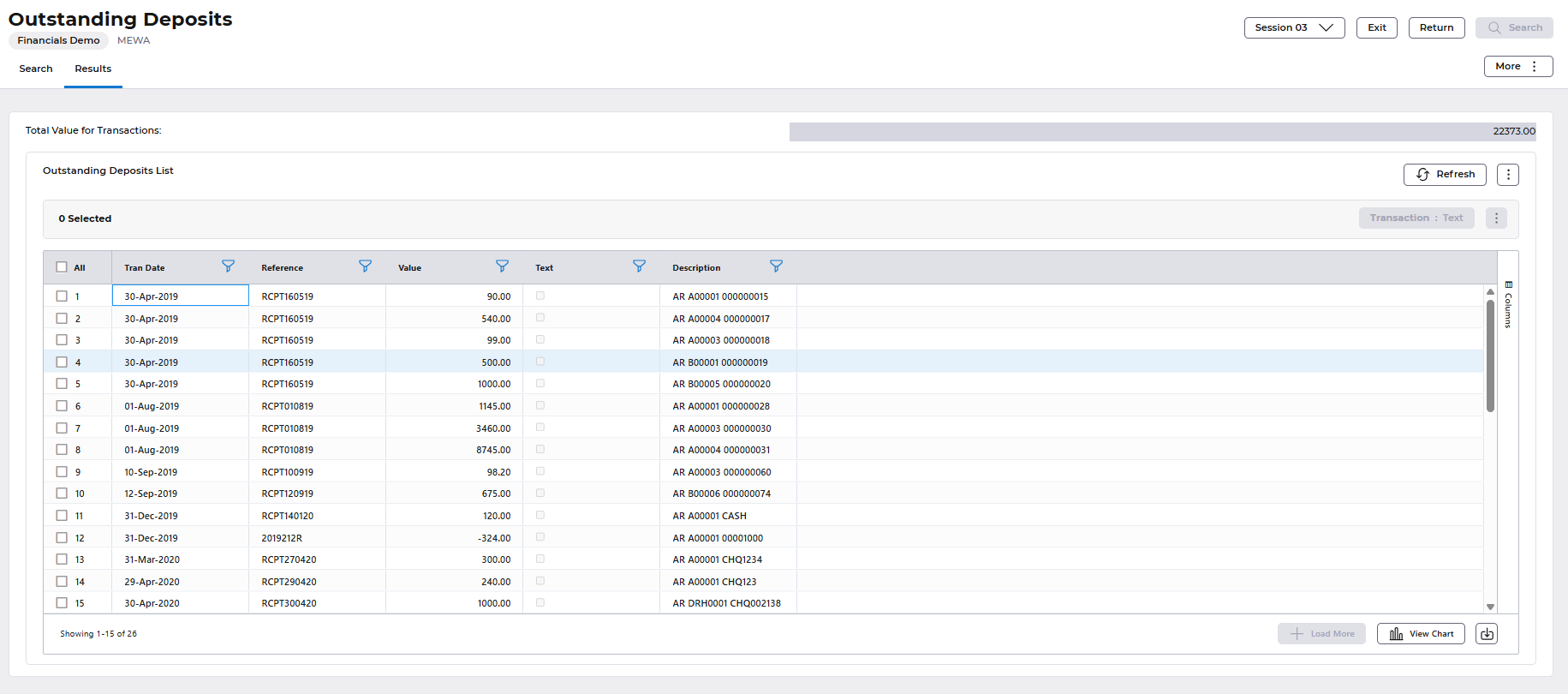

Outstanding Deposits (not Banked)

Using this screen you will be able list all receipts entered on AR system but not yet deposited in the Bank Account.

The following fields are mandatory:-

Company Enter a two character company code for which Bank Reconciliation Company Controls have been created. Current user company will default into this field.

Bank Code Enter the two character bank code corresponding to the required bank account.

Enquiry Leave as default or select different enquiry from pull down menu. Select the 'Search' button, the user will be presented with the Deposits Not Banked List.

The screen is very similar to the Miscellaneous GL Items screen and the following information is displayed:

Transaction Date: The general ledger transaction date

Reference: Deposit Reference Number

Description: Accounts Receivable Ledger and Customer Number

Value: Receipt Value

The Excel download button is available from this screen.

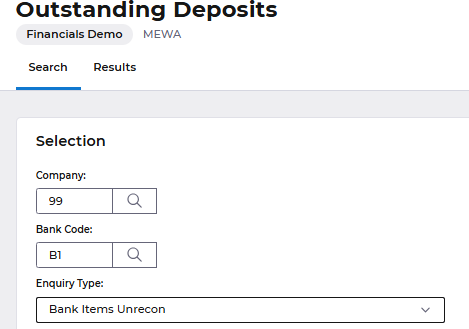

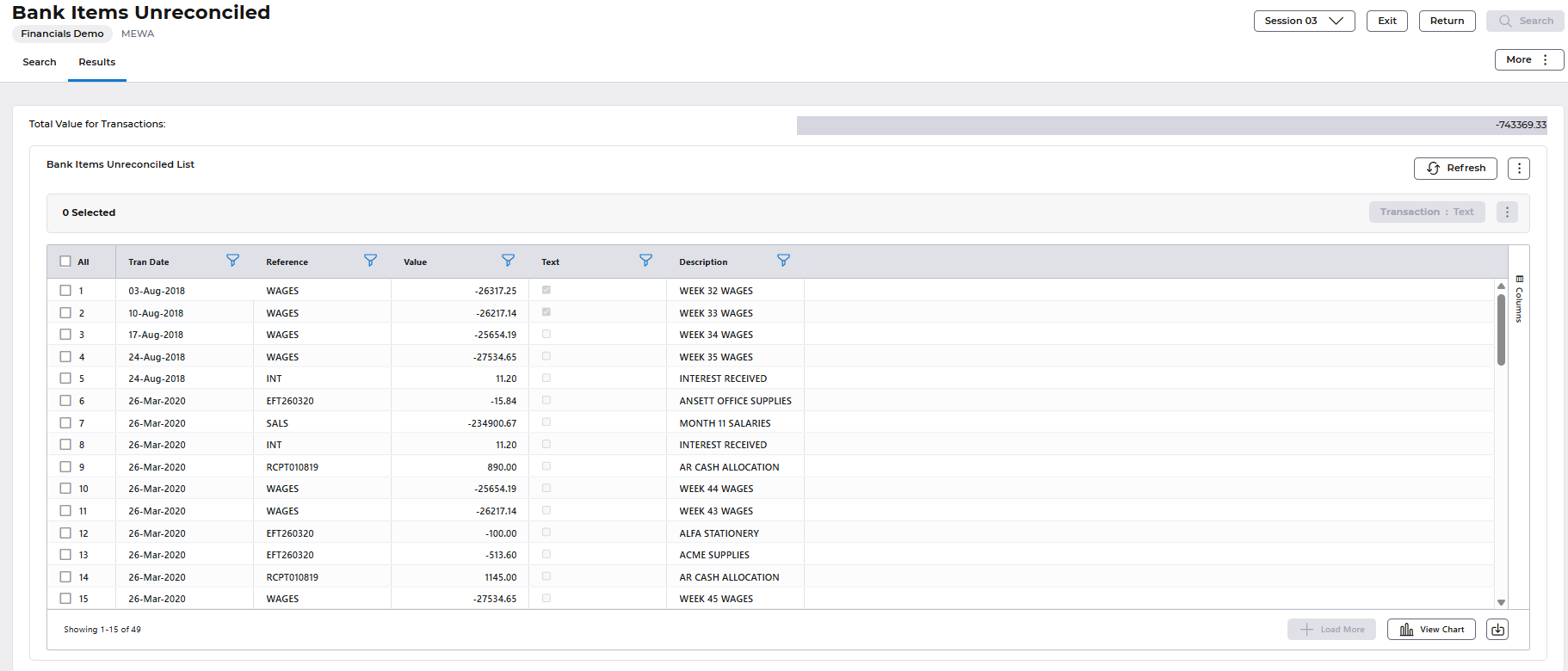

Bank Items unreconciled

Use this screen to produce a list of all Bank Items held as transactions in the Bank Statement and Bank Adjustment Balance Classes and not yet reconciled:

The following fields are mandatory:-

Company Enter a two character company code for which Bank Reconciliation Company Controls have been created. Current user company will default into this field.

Bank Code Enter the two character bank code corresponding to the required bank account.

Enquiry Leave as default or select different enquiry from pull down menu.

Select the 'Search' button, the user will be presented with the Unreconciled Bank Items List.

The following information is displayed: -

Transaction Date: Date of Bank Statement Transaction

Reference: Reference Number

Description: Description from Bank Statement transaction or, if blank, the description of the Bank Statement batch type

Value: Transaction Value

The Excel download button is available from this screen.