Release Notes 2025

December 2025

November 2025

October 2025

September 2025

August 2025

July Release

June Release

May 2025

April 2025

March 2025

February 2025

January 2025

Frequently Asked Questions!

How do I see descriptions of codes in enquiry screens?

How do I access field level help?

How can I delete a payment run

How do I stop over receipting of orders

Why has my transaction not appeared on the payment run?

How do I stop a user posting to a prior and future period

How to copy and delete lines during data entry?

Prevent user posting to specific balance classes

Download Templates

User setup requires multiple screens and is complicated!

Changing security access to a user

Out of office

How do I give a user read only access?

De-allocate and an AP Payment

Can I run a report to view security groups against my users?

Hints and Tips!

Useful information to include when raising Financials cases

Navigation Hints and Tips

Browse Timeouts

Accounts Payable Quick Cards

Accounts Payable Supplier File

Accounts Payable Data Entry

Log Invoice/Credit Note

Enter a logged Invoice

Non Purchase Order Related Invoice Entry

Order Related Invoice

Order Related Invoice with Mismatches

Order Related Invoices - mismatch scenarios

Mismatch Types

Accounts Payable Enquiries

Accounts Payable Payments

Payment Processing

AP Payment Cancellation

Create a manual payment

Re-run Bacs Remittance

Payment Processing Audits

Single Supplier Payment Processing

Transaction Maintenance

CIS Processing

Accounts Payable Code Tables

Accounts Receivable Quick Cards

Customer Maintenance

Data Entry and DDI Mandates

Enquiries

Cash Allocation

Credit Control

Student Sponsor

General Ledger Quick Cards

Chart of Accounts Setup

Create a new nominal code

Create management and analysis codes

Creating and Amending Nominal and Management code relationships

Create a new GL Structure Element

General Ledger Data Entry

General Ledger Enquiries

Period and Year End Close

General Ledger Security

Fixed Assets Quick Cards

Prompt File - Asset Creation Updated

Fixed Assets Period End & Depreciation Updated

Revaluation

Disposals

Relife

Purchasing Management Quick Cards

Inventory Management Quick Cards

Return to Store

Stock Taking

Create Demand on Store (Financials)

Bin Transfers

Stock Disposal

Stock Adjustments

Import Tool Kit

Reconciliation Processes - Helpful how-to guides

Daily Checks

General Ledger Reconciliation Reporting

Accounts Payable Reconciliation Reporting

Accounts Receivable Reconciliation Reporting

Fixed Assets Reconciliation Reporting

Purchasing Management Reconciliation Reporting

Procurement Portal

Procurement Portal Overview

Navigation

Requisitions

Orders

Authorisation

Receiver

Invoice Clearance

Portal Administration

Procurement Portal – Teams Setup

Invoice Manager

Bank Reconciliation

Bank Reconciliation Overview

Bank Reconciliation Menus Explained

Bank Reconciliation Company Controls

Bank Reconciliation Code Tables

Transaction Types and Sub Types

Bank Reconciliation Enquiries

Bank Reconciliation Reports

Manual Bank Reconciliation

Bank Reconciliation Take-on

Unmatching Transactions

Reporting

General Ledger Reports

Account Payable Reports

Fixed Assets Reports

Sales Invoicing Reports

Accounts Receivable Reports

Bank Reconciliation Reports

Purchase Invoice Automation (PIA)

January 2026

Deleting Supplier training data

Resetting password - Smart Workflow

Purchase Invoice Automation (PIA)

Adding a New User - Smart Workflow

Password Reset in Smart-Capture

Suggested Testing Areas

Release Notes 2024

December 2024

November 2024

October 2024

September 2024

August 2024

July 2024

June 2024 Release

May 2024 Functional Changes

Release Notes - New UI Improvements

June Release 2024 - New UI Improvements

May Release 2024 - New UI Improvements

April Release 2024 - New UI Improvements

Financials Design Improvements

User Interface Overview

User Preference Improvements

Alerts & Field Error Focus

The all new Data Grid!

Input Fields & Dynamic Validation

Screen Structure

Miscellaneous New Features

Generic Actions

Chart Functionality

Bring Your Own BI (BYOBI)

Collaborative Planning

Financial Reporting Consolidation

Business Process Manager

Request a Customer

Request a Supplier

Request a Sales Invoice

Request a Management Code

Request a nominal code

Create a Pay Request

API

Air Approvals

Contents

- All categories

- Accounts Receivable Quick Cards

- Credit Control

- Credit Control Overview

Credit Control Overview

Updated

by Caroline Buckland

Updated

by Caroline Buckland

Overview

This article introduces the concept of credit control (debt management)l. The credit control facility is a powerful tool allowing credit controllers to manage debt and record notes and actions at account and transaction level.

To access Credit Controls select the following menus:

Accounts Receivable>AR Processes>Credit Controls>Credit Control List

The main areas associated with credit control are as follows:

Credit Limit Maintenance

The user can maintain credit information associated with a customer account.

Query Management

Allows the user to record one or multiple queries against a transaction(s) at transaction and/or item level. Workflow to action other users can be triggered using the Business Event Manager.

Transaction Amend/Dispute

The user can enquire, amend, dispute and release transactions.

Diary

The user can list and maintain diary entries as appropriate and send workflow to other users using Business Event Manager.

Dunning

Dunning is used to classify and control the production of credit control letters for overdue amounts.

Credit Limit Maintenance

Credit Control List

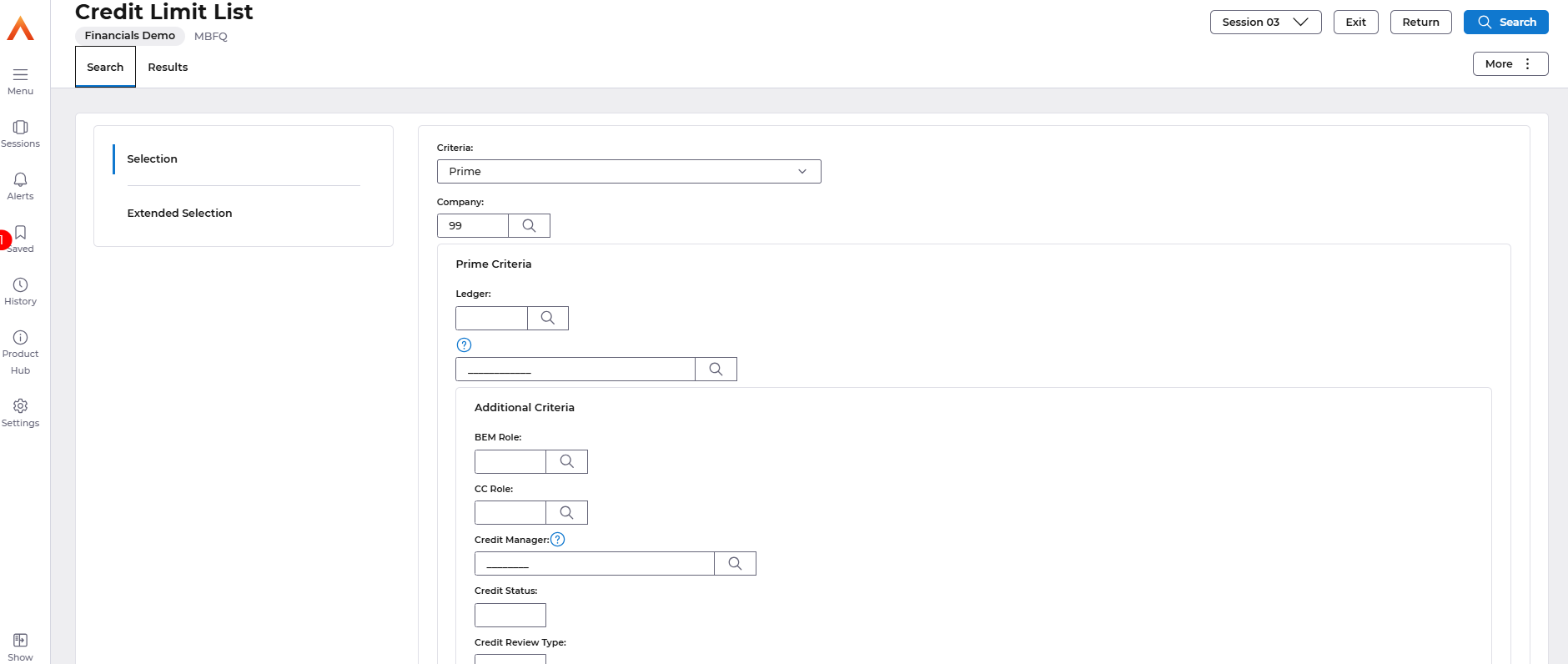

The credit control list allows the user to retrieve a list of customers and their associated credit limits using different selection criteria. There are three types:

- Primary Search - Search by a variety of criteria including Ledger/Account, Credit Status, Stop Credit indicator, Legal Hands indicator, Credit Manager, Credit Review Type, Debt range, Overdue amount range and Credit Limit range

- Name Search - Search by customer Short Name

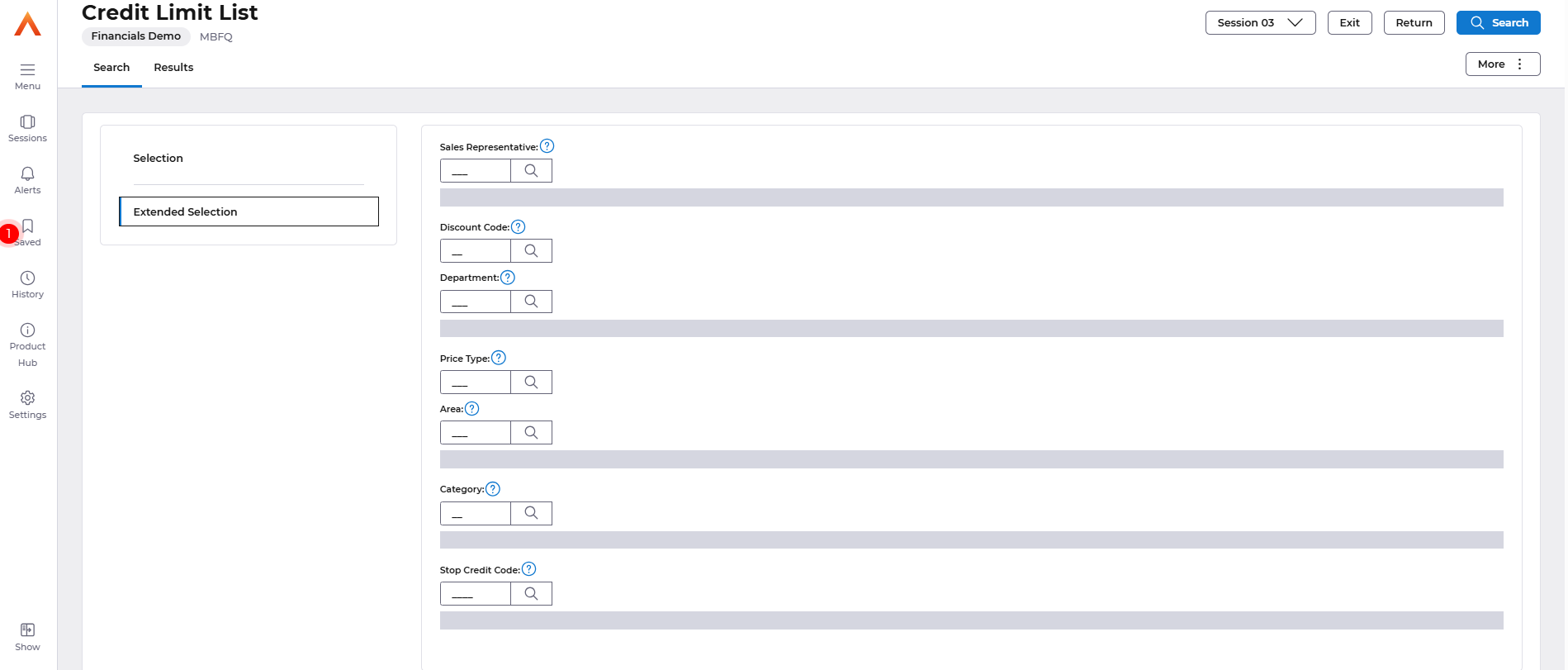

- Extended Selection - permits further selection by the Analysis Codes and the Stop Credit Code.

If no parameters are entered, the user can build a list that will display every customer account currently on the Accounts Receivable company. The ‘More’ action may be needed to build a full list.

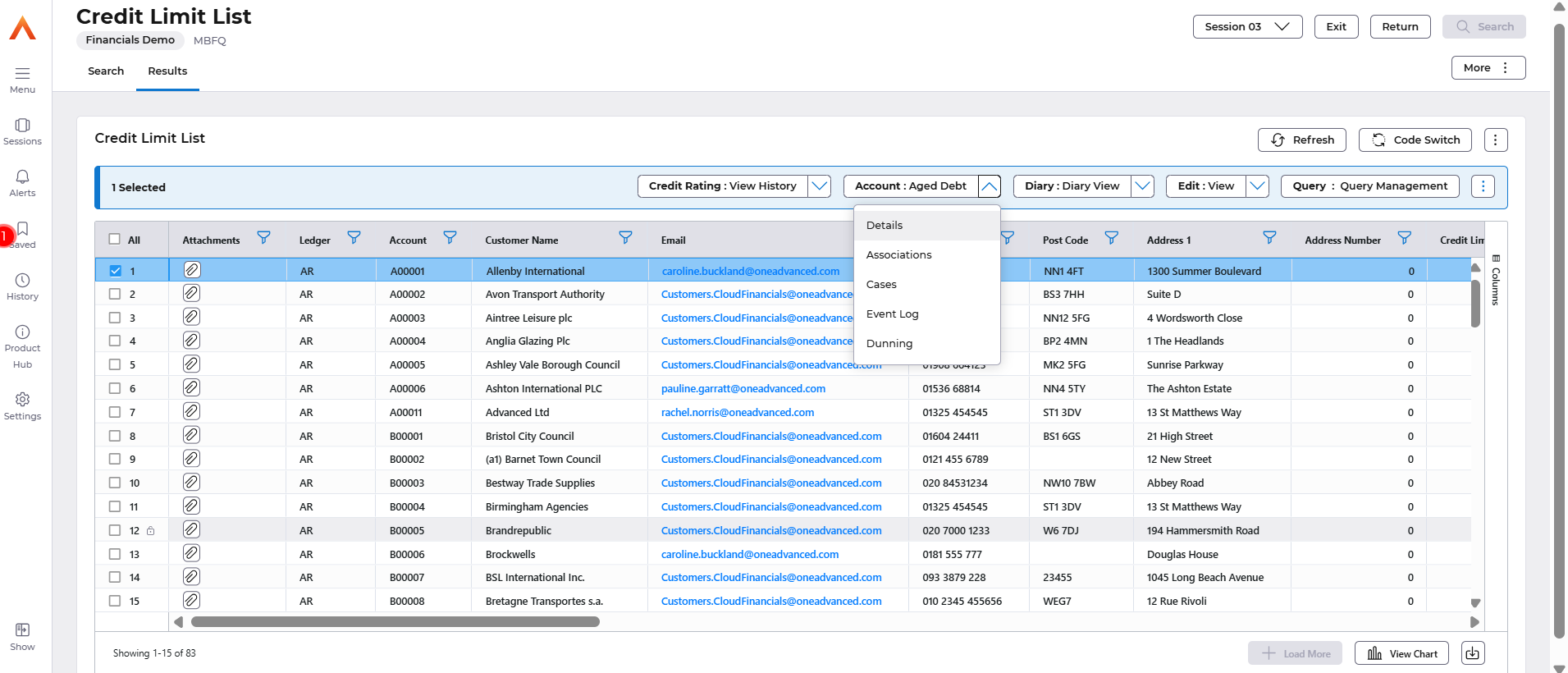

The credit control list is a very powerful tool offering the user direct access to many of the AR facilities without having to go through the usual route of selecting the relevant menu options.

As an example, from the Credit Control List, the user can directly access Account Details, and from there they then have access to the enquiry facilities that opens up further enquiry facilities. This means users do not have to keep exiting back to the menu screen and selecting another option which is time consuming and inefficient.

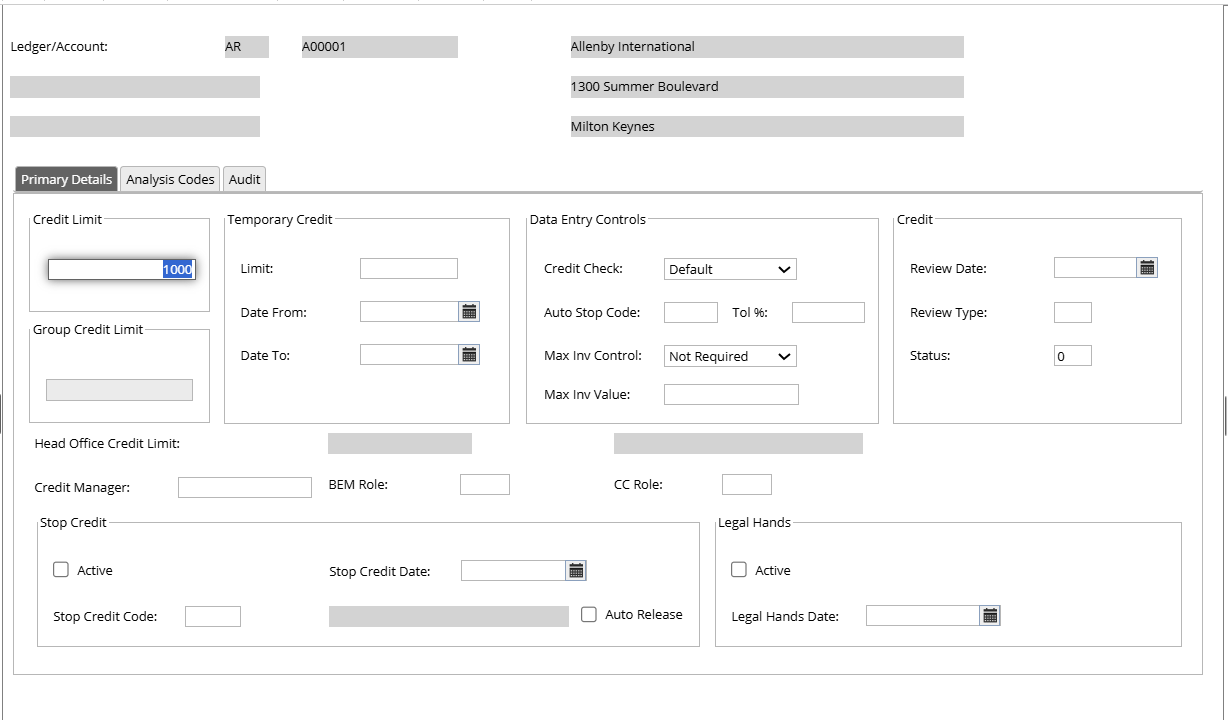

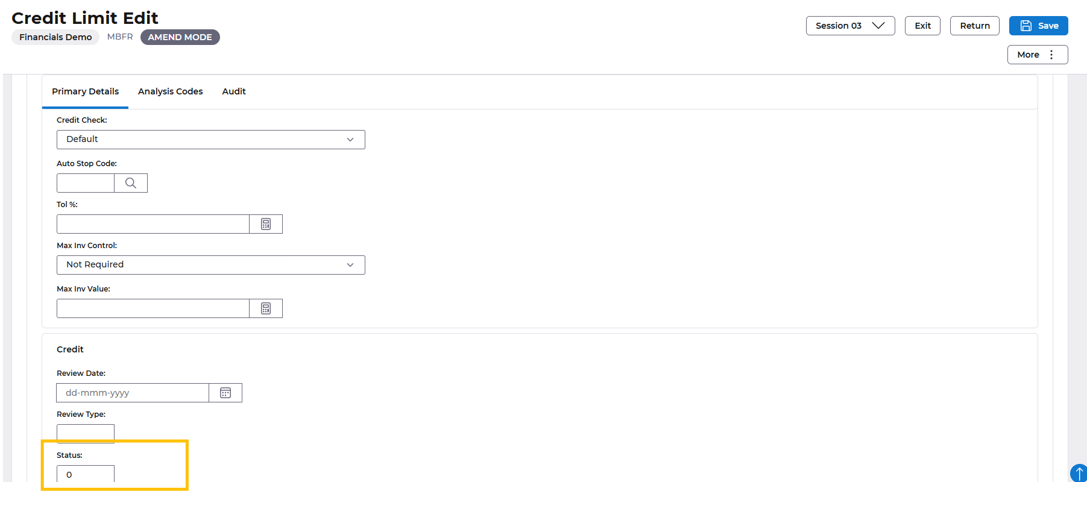

By selecting the ‘Amend’ action against an account, the ‘Credit Limit – Edit’ screen will be displayed. All fields on this screen can be amended.

Credit Status

Within the Credit Limit Maintenance screen, the user can manually maintain the current Credit Status of the customer.

To achieve this, the user may enter a value in the range of 0-9 in the Credit Status field. The way in which these numbers are used is totally user-defined. Credit Statuses are not codes and therefore cannot be pre-defined. 0(zero) denotes that statuses are not in use.

Credit Statuses can be used to put a customer into ‘Stop Credit’ and/or ‘In Legal Hands’. If these facilities are to be used, then two numbers from the value range 1-9 must be set in the Company Controls. For more information on what has been set at company control level, raise a support case for more information.

Example

It has been decided to use numbers 3 and 4 for ‘Stop Credit’ and ‘In Legal Hands’ respectively, so these are entered into Company Controls.

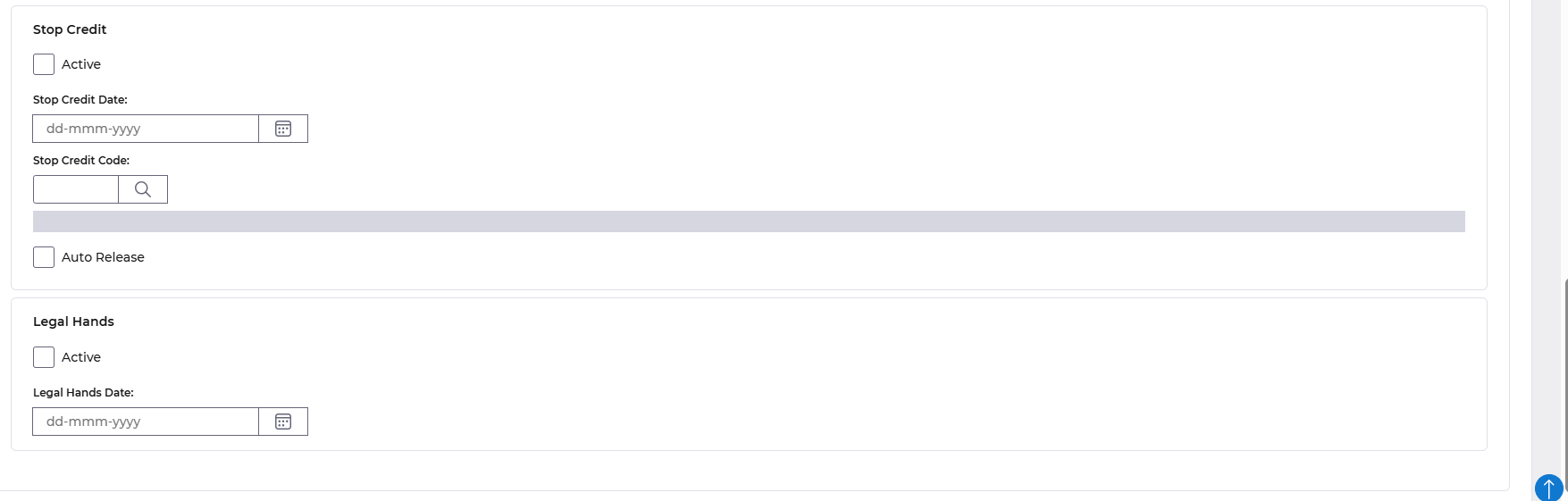

To place a customer account into ‘Stop Credit’, the user must change the customer’s status to 3 in the Credit Status field. The Stop Credit Indicator must be flagged and a Stop Credit Date greater than or equal to today’s date must be entered. In addition a Stop Credit Code must be entered to indicate the reason for the customer’s credit being stopped. This field is promptable.

To place a customer account into ‘Legal Hands’, the account must first have been placed in ‘Stop Credit’. The user must change the customer’s status to 4 in the Credit Status field. The Legal Hands Indicator must be flagged and a Legal Hands Date greater than or equal to today’s date must be entered.

Putting a customer into ‘Stop Credit’ or ‘In Legal Hands’ has an effect on other areas within Accounts Receivable. These are:

- Data Entry

- Transfers

- Cash Allocation

- Account Enquiries

When the user enters the customer’s Ledger/Account details and validates/updates the screen a warning message is displayed which can be overridden.