Contents

Interest Charges

Updated

by Caroline Buckland

Updated

by Caroline Buckland

The Process

To allow the user to generate Interest charges against overdue transactions, Financials will calculate the Interest charge against either overdue account or transaction balances. Interest calculations are prepared using either Simple or Compound Interest and the Interest charge appears on Financials in the form of an Interest Invoice. Any interest charge Invoices must be rated as tax exempt for VAT.

The user may separate a customer’s standard account balances from the Interest transactions by utilising a replica account in an Interest Ledger.

Authorisation can be used to allow checking of Financials interest calculations before they update the Customer’s account.

Financials provides an interest charges report.

The following areas should be considered before implementing your interest charges controls.

- Company Level Controls

- Ledger Level Controls

- Customer Controls

- Transaction Legend Controls

- Interest Rate tables

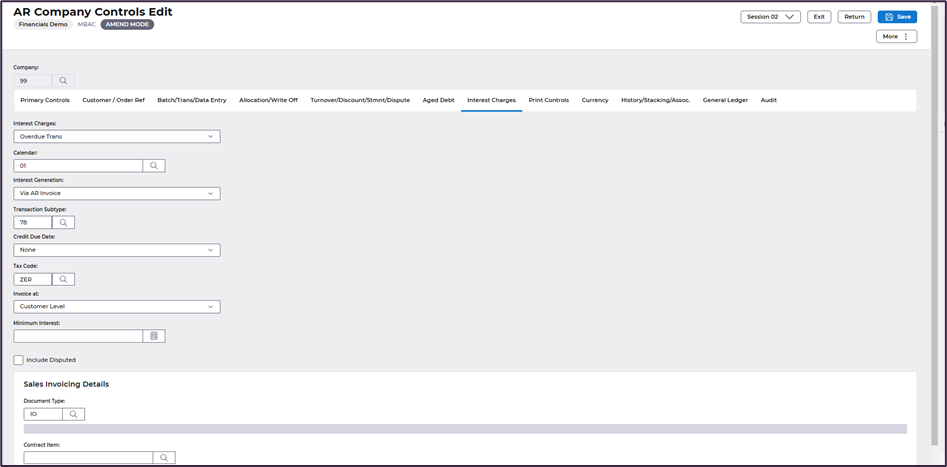

Company Controls

This option can only be accessed by Advanced staff, please raise a support case for help.

Here you establish your company policy for interest charges.

Interest Charges

This determines when interest should be charged on transactions. The following options are available:

- Only when a transaction has been fully paid.

- interest is charged on all overdue transactions

Interest Calendar

An Interest Calendar must be defined if the user wishes to calculate interest from the fully paid date. This aids in the calculation of compound interest.

Interest Generation

Should Interest Invoices be authorised before they update Sales Ledger?

The Interest Generation indicator can be set to: 0 - None 1 – Accounts Receivable (it will enter an invoice on to the customer account but not a Sales Invoice so a pdf will not be created) 2 – Sales Invoice Document 3 – Sales Invoice Contract It will indicate how the Interest Invoice will be created.

Transaction Sub-Type – a new code can be created

When the Interest charge is calculated, the charge is entered onto the system in the form of an Interest invoice. A sub-type must be nominated here. The sub-type can then have appropriate GL coding linked to it, and an appropriate legend.

Credit Due Date

From which date should interest be calculated? The due date or the transaction date.

Tax Code

A Tax Code, which must be rated as zero rated, has to be associated with the Interest Invoice.

Invoice at

Should a single Interest charge Invoice be created for the whole customer account, or individual interest charge invoices for each individual transaction?

Minimum Interest

Used to specify the minimum value that an interest charge transaction must be before it will be generated (note, if a contract line is to be generated then the minimum value will not apply)

Include Disputed

Should transactions that have been suspended be included in Interest charge calculations?

Sales Invoicing Details

Document Type – a new code can be created

Used to specify the Sales Invoicing Document Type to be used when generating an SI document from the interest charge transaction. Must be a valid SI Document Type and can only be entered when SI is in use for the AR Company.

Contract Item

Indicates the Item Code, which will be used when generating Interest Charges in Sales Invoicing Contracts. Can only be set if Interest Mode is 3. (SI Contract)

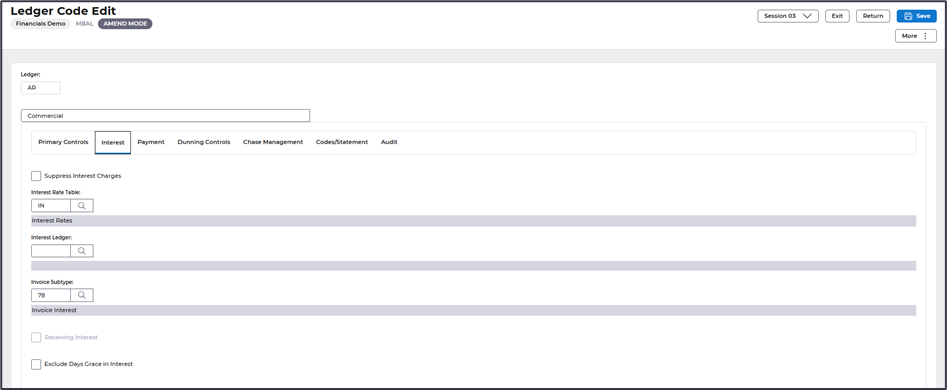

Ledger Controls

This option can only be accessed by Advanced staff, please raise a support case for help.

Suppress Interest Charges

Here you establish individual Ledger policies for interest charges.

Set this flag to indicate that interest invoices are not generated for ledger customers.

If left blank (the default), interest transactions and reports are generated for customers in the ledger. This field cannot be entered if Fully Paid/Outstanding in Company Controls panel (MBAC) is set to 0.

Interest Ledger

You may post Interest charges to a separate customer Ledger.

Interest Rate Table

Which Interest Rate Table should be used as a default for customers within this Ledger?

Invoice Sub-Type

An additional sub-type may be specified here; this would then allow you to differentiate between Interest sub-types for different Ledgers.

Receiving Interest

This field is display only. If the user is pointing Interest charges at this ledger then this field will show as flagged.

Exclude Days Grace in interest

Set this flag if you wish to exclude the Days Grace in any interest calculations made for a customer, interest will be calculated from the due date of the invoice. If the flag is not set, then the interested is calculated from the due date PLUS the number of days grace (i.e. reducing the interest charge). The flag does not affect the date at which an interest charge will become liable. The days grace is set at Customer level and specifies how many days to pay beyond the due date are allowed before interest is generated.

Customer Controls

Menu access: Accounts Receivable>AR Processes>Maintain Customers

Optionally the user may establish different Interest charging policies at customer account level.

Interest Exempt

Interest charging can be switched off at Customer Account level on the Discount/Suppress format.

Interest Rate Table

A different Interest Table may be nominated on the Indicators format to override that defined at Ledger level.

Compound Interest

Should simple or compound Interest charges be used?

Flag this field to use compound interest. Compound interest can only be used if Interest calculation is based on fully paid transactions.

Interest Days Grace

A number of days can be added to the transaction’s due date, to indicate a number of days grace before interest calculation should commence.

Transaction Legend Controls

The user must indicate at Invoice Type/Sub-type level whether the transaction should be included in interest charging.

Include in Interest Charges

Should the transaction be included in interest charging?

Interest Table Name

The code identifier for this set of Interest rates. The user may create multiple tables, so that different rates may be maintained for the same effective dates.

Interest Sub Type

Enter the Interest Subtype that will be used for any transaction using this transaction legend when creating the interest charge.

Menu access: Systems Controls>Module Controls>Accounts Receivable Controls>AR Credit Management Controls>Interest Rates

Interest Rate Tables

In order that the system can calculate how much interest to charge, the user must define Interest Tables, with appropriate rates and effective dates.

Interest Table Name/Description

The code identifier for this set of Interest rates. The user may create multiple tables, so that different rates may be maintained for the same effective dates.

Effective Date

From which date should the Interest rate apply.

Interest Rate

Nominate the % rate of interest to apply.

Interest Charging - Example

The user has two Customer Ledgers:

Ledger 1 - Wholesale

Ledger 2 - Retail

Ledger 1 “aims” its Interest postings at Ledger 3 (Interest Receivables)

Ledger 2 retains interest postings within the original accounts.

Ledger 1:

Customer Account is L1 A0001.

When interest charging is active, a duplicate account will be created automatically in Ledger 3 and the account number will be L3 A0001

The original transactions will still be held on account L1 A0001

The interest transactions will now be held on account L3 A0001

Ledger 2:

Customer account L2 A0001 and all transactions will be held on account L2 A0001

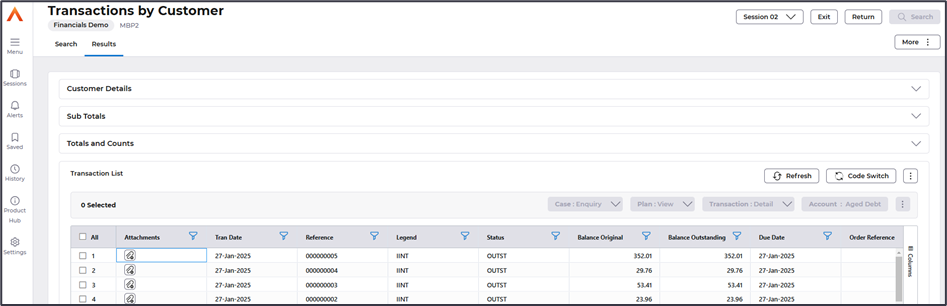

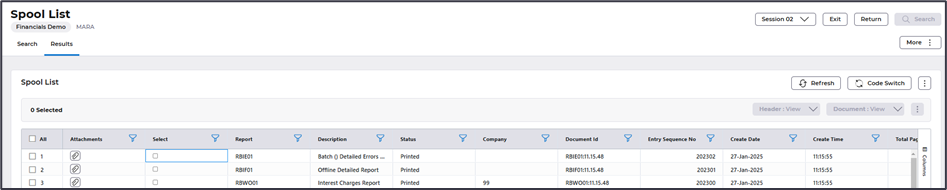

Interest Charging – Reports and Enquiries

Reports / Enquiries

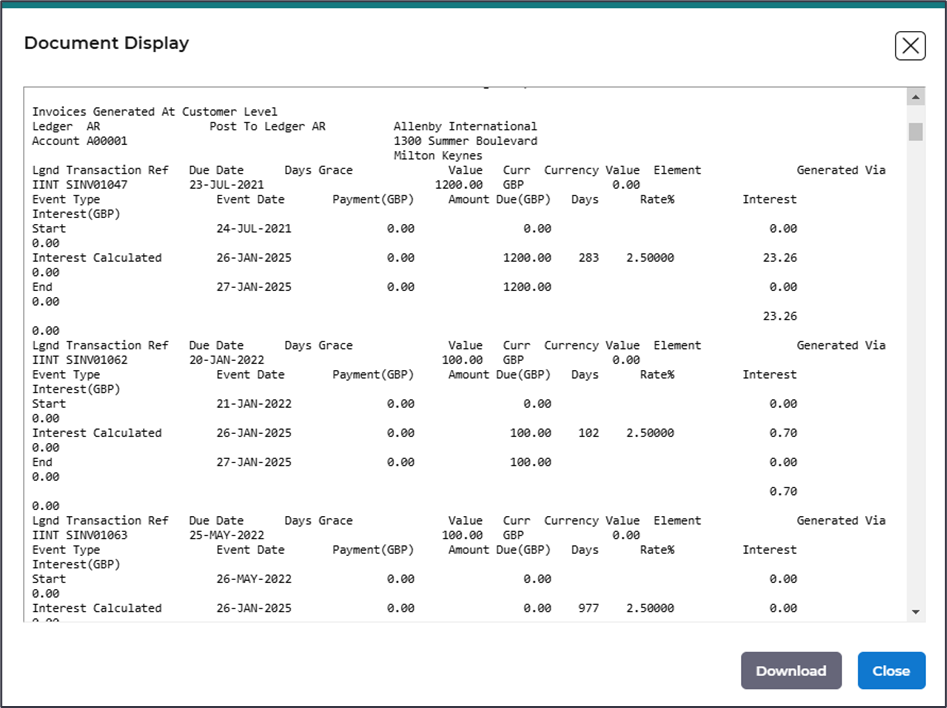

The system provides a standard Interest report which gives details of Interest charges calculated and postings made. Similarly, the user may enquire upon Interest transactions created on-line. Where Interest transactions will appear on the system will depend on whether or not the user is posting interest calculations to an Interest Receivable Ledger.

The process BW1 calculates Interest charges. The following parameters are available:

Company

In a multi-company environment, the user can restrict Interest calculations to a single company.

Ledger

Similarly, Interest calculations may be limited to customers within a given Ledger.

Run Date

Used to specify a parameter run-date. If left blank, the system date is used.

Frequency

Use this field to select a range of customers that you wish to calculate interest for. The frequency code allows you to schedule Interest, and Statement runs simply for the same set of customers. By setting a schedule with BW1 / BS1 set to run, each with the same frequency code on the schedule you can calculate interest for a group of customers immediately prior to producing statements. Different frequency codes can be run on different daily schedules according to your Customer Care policies to enable a spread of statement runs throughout the working week.

Report Indicator

All Transactions

Transactions Settled After Due Date

Transactions With Interest Generated

Access the Spool to view the reports. Systems Admin>Spool

The invoices can be viewed from the enquiries screen.

Accounts Receivable>AR Enquiries>Transaction Enquiries>Transactions by Customer